Risk management is topical in the physical asset management arena. AM experts and industry practitioners advocate the integration of relevant and purposeful risk management practices for the optimal utilisation of physical assets.

What is risk management?

Risk management is the identification, assessment and prioritisation of risks and the associated plans and actions to minimise the probability of occurrence and the negative impact that these risks might have on an organisation. This leads to the question: what is considered a risk? ISO 310001 defines risk as “the effect of uncertainty on objectives”, which means a risk arises from uncertainty related to financial markets, project failures, legal actions, accidents, natural disasters, business discontinuity, etc.

The effective management of an organisation’s risks is an essential part of business continuity. All risks can never be fully avoided, and some level of residual risk needs to be accepted. However, it is important that all risks should be isolated, defined and managed within financial and practical constraints.

Risk management and asset management

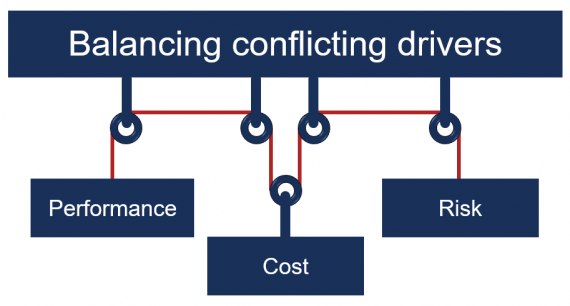

Physical assets have inherent risks and potential failures, but the link between risk and asset reliability is not always obvious. In general, risk is calculated as the probability of an adverse event occurring multiplied by the consequence of occurrence. If the probability of a failure occurring is zero, you have a perfectly reliable asset with zero risks. Asset reliability or operational uptime is therefore inversely linked to the number of risks you allow to occur on your assets – the higher your risk, the lower your asset reliability. Recognising potential risks and their consequences and preventing them from occurring is fundamental to asset management.

ISO 55000 states that an organisation should take the necessary action to address risks when planning for its asset management system. This implies that an organisation should establish, implement and maintain documented processes for the ongoing identification and assessment of asset-related and asset management-related risks, and the identification and implementation of the necessary control measures throughout the life cycle of the assets. The overall purpose of asset risk assessment is to understand the cause, effect and likelihood of adverse events occurring, to manage such risks to an acceptable level optimally, and to provide an audit trail for the management of risks.

Typical risk management challenges

In today’s business environment, an asset manager is faced with three challenges in managing asset-related risks: This includes the confidence that the asset risk management framework which is in place is effective, the scope of what business aspects to manage as part of asset risk management activities, and the isolation of risk management from daily asset management. A further challenge is the isolation of risk management from daily asset management. It is important to create a wider awareness of risk management and make it an integral part of all asset management decisions.

Pragma’s approach to risk management

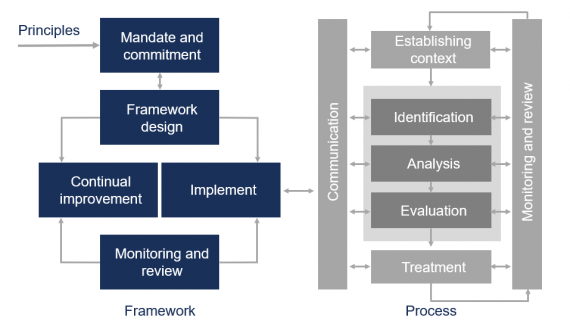

At Pragma, we believe the effectiveness of your asset risk management framework determines the success of your risk management efforts. Your framework should serve as the basis for ensuring all asset risk stakeholders successfully manage risk. The framework should also facilitate the management of risks through the application of a tailored risk process which is specific to the various stakeholders in your organisation and relevant to their context.

Through the Pragma Way, we assist our clients in developing an asset risk management framework and process. This overcomes the challenges of effectiveness, uncertainty and asset risk scoping difficulty. We narrow the scope of asset risk management down to business risk and asset risk.

Asset risk management affects everyone in the organisation and should form part of its culture, so we take senior, tactical and technical teams through asset risk management training to sensitise everyone affected by asset-related risks.

Following the training, we will work with you to develop a risk management framework which supports your business, asset management system and asset-related risks. As part of the framework development, we address and develop the following with you:

- A risk process: A systematic process, with supporting templates and tools, which aligns ISO 31000 requirements for establishing the risk context, assessing risks, risk treatment and the related communication, monitoring and review related to risk management.

- Risk registers: Registers for identifying, analysing and evaluating risks with likelihoods, consequences and mitigation plans. Risk registers for business risk and asset-related risk, ie criticality analysis, are established.

- Risk treatment cycle: Decision logic to evaluate and select risk treatment options and the tolerance of risk levels.

- Risk monitoring and review process: A process for monitoring and reviewing the risk registers, which is integrated into the risk management framework and process.

Speak to us to define and develop your risk management process.